How close is a U.S. strike on Venezuela?

Relations between the U.S. and Venezuela have sharply deteriorated in recent weeks, shifting from long-standing diplomatic and economic tensions to the edge of open military confrontation. Since early September, the U.S. has conducted multiple lethal strikes on vessels operating out of Venezuela: on September 2, an airstrike killed 11 people allegedly linked to the Tren de Aragua gang – an action Venezuela denounced as unlawful aggression; on September 15 and again around September 19, further strikes killed three in each case.

In parallel, Venezuelan forces have responded with military exercises, aerial maneuvers (including F-16 flyovers of U.S. naval vessels), which was received as a provocation by the U.S., and rejections of U.S. narratives.

This escalation is taking place against the backdrop of Trump’s longstanding rhetoric on Venezuela, where he has repeatedly floated the idea of a U.S. invasion as a way to remove Maduro and restore democracy. At the same time, sanctions pressure is mounting: the expiration of broad U.S. Treasury licenses and their replacement with a more restrictive authorization – which now limits Chevron to exporting only about half of its Venezuelan crude and bans cash payments to Maduro’s government – raises the prospect of sharper economic confrontation.

On the political front, the U.S. administration has also elevated its rhetoric: designating President Nicolás Maduro head of a narco‐terrorist organization, doubling the bounty for his arrest, and issuing a warning that Venezuela must take back deported prisoners and people from mental institutions or face an “incalculable” price. On the other hand, Maduro offered to open direct talks via a letter, which as of yet appears to have been unanswered publicly.

Together, these developments have prompted Swift Centre forecasters to consider scenarios beyond strikes in international waters. They are asking whether the standoff could tip into a direct strike on Venezuelan territory. They also consider what consequences such an operation would have for Venezuela’s leadership, economy, and international alignments.

Key takeaways:

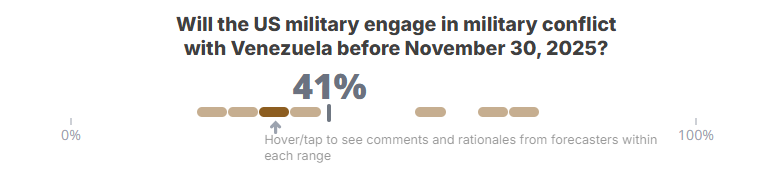

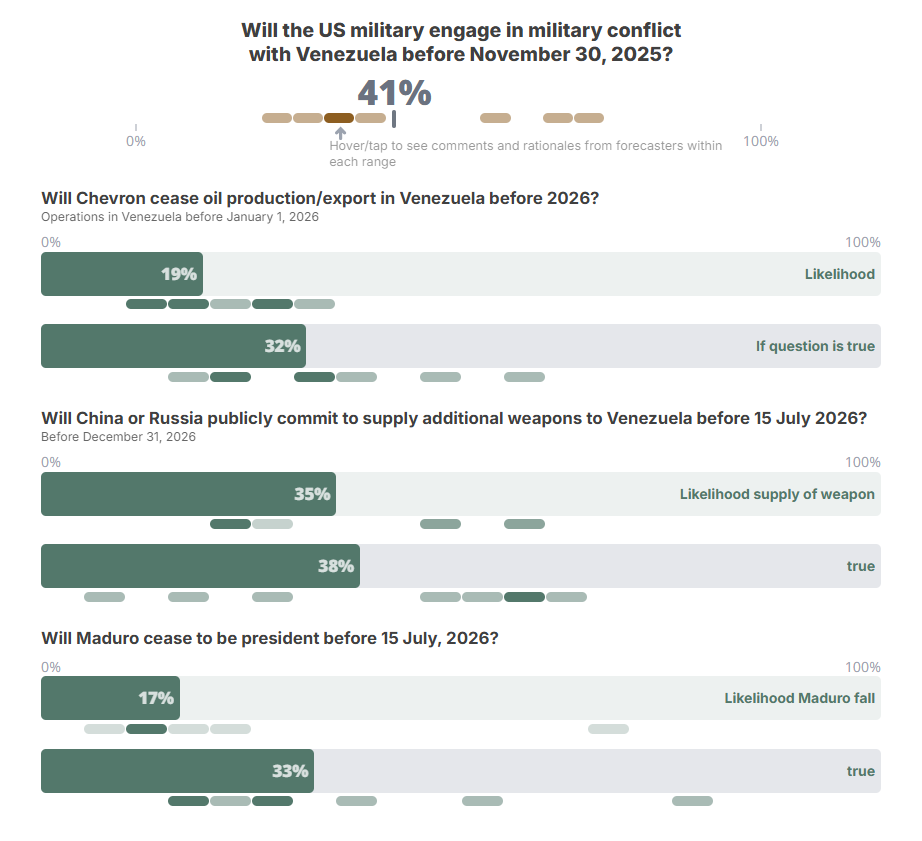

Escalation risk is real: forecasters put the chance of U.S. military conflict with Venezuela at ~41% by November 2025, noting that the current force posture in the Caribbean is larger than required for drug-control alone.

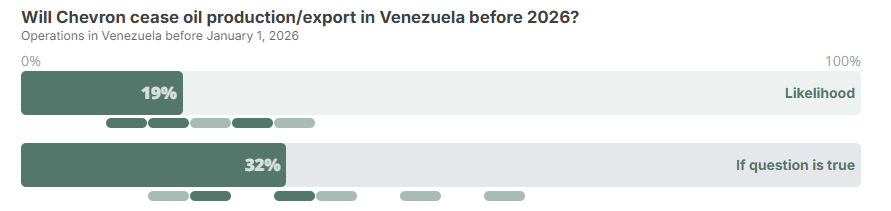

Spillover effects of a strike could be significant: Chevron’s exit from Venezuela risk rose to ~1 in 3, and Maduro’s removal to the same level.

Russia and China are seen as unlikely to publicly commit to supply additional weapons in response to a U.S. strike, but their existing defense ties with Caracas are already substantial – a reminder that these tensions extend beyond the U.S. and Venezuela.

Will the U.S. military engage in military conflict with Venezuela before November 30, 2025?

A "military engagement" is defined as any incident involving the use of force such as missile strikes, artillery fire, exchange of gunfire, or other forms of direct military engagement between US and Venezuelan military forces. Non-violent actions, such as warning shots, artillery fire into uninhabited areas, or missile launches that land in territorial waters or pass through airspace, will not qualify for a "Yes" resolution. Intentional ship ramming that results in significant damage to (e.g., a hole in the hull) or the sinking of a military ship by another will count toward a "Yes" resolution; however, minor damage (scrapes, dents) will not. Any U.S. military kinetic strike that impacts Venezuelan land territory will qualify for a “Yes” resolution. Missiles or drones which are intercepted and surface-to-air missile strikes will not be sufficient for a "Yes" resolution, regardless of whether they land on adversarial territory or cause damage.

Forecaster views span from 20% to 70%, with an overall aggregation at 41%.

Current posture in the Caribbean

Forecasters noted that the force mix currently in and around the Caribbean – several warships (plus a fast-attack submarine), the 22nd MEU with amphibious shipping, and F-35s staging through Puerto Rico – was far larger than needed to intercept a few go-fast boats. At the same time, they noted that the artillery was too limited to support either an invasion or a “decapitation move” in Venezuela.

Forecasters were divided on how to read this ambiguity. Those assigning higher probabilities saw the buildup as a clear signal of escalation: As one put it: “Navy vessels like those being deployed aren’t needed to destroy small boats […] Everything is still very much in a preparation stage, [...] but I think everything will be ready to go most likely by early October, if not sooner.” Some also pointed to reports that the White House was considering broader legal powers against ‘narco-terrorists,’ though forecasters debated how meaningful that signal really was.

By contrast, lower-end forecasters emphasized political and media signals: “Trump’s two posts explicitly emphasized the strikes were in international waters,” “I think the whole thing (so far) is to intimidate Venezuela into making some form of concessions.”

There was also a common operational judgment: if anything happens on Venezuelan soil, it is unlikely to be an amphibious or armor-heavy move from the sea. One said: “The vast majority of my forecast is for an aerial or missile strike on an alleged narco-site—not an invasion.”

Motivation: drug control, regime pressure, or something else?

Although the U.S. has framed its posture in Venezuela as a counternarcotics mission, most forecasters doubt drug control was the real aim. They highlighted the mismatch between the stated mission and the assets deployed: “I don’t think the actual goal of these military deployments is the stated goal of combating drug trafficking… it’s literally overkill, and other approaches are generally considered more effective [to combat drug trafficking].” They also noted that fentanyl (the main driver of U.S. overdoses) is produced largely in Mexico using precursors from China, and that most cocaine originates in Colombia and moves via Pacific routes – making a Caribbean naval buildup a poor fit for the problem.

Given that mismatch, many forecasters judged the more plausible aim was to pressure Maduro, either to extract concessions on migrants, oil and limited political openings, or to lay the groundwork for riskier moves later. One explained: “The deployment is intended to pressure Maduro and his inner circle […] a strike may increase the pressure, but a deal could arrive first, rendering it unnecessary.” That reading aligns with Trump’s threat of “incalculable” costs unless Caracas took back “prisoners and people from mental institutions,” and with Maduro’s letter offering direct talks, which so far has not been publicly accepted.

Several forecasters converged on regime change as the most plausible high-end objective, splitting on method. One sketched a decapitation option: “It seems very slightly plausible to me that the administration's goal is to capture Maduro. All of the statements coming out of the administration, from doubling the bounty for Maduro's arrest to $50M, to designating Maduro the head of a narco-terrorist organization and declaring that he is not the legitimate leader of Venezuela, point to a strong desire to see him out of power.” Others considered the possibility for coordination with local groups: “Given that 2200 Marines aren't going to overthrow the government of Venezuela, it seems likely to me that the administration is at least considering working with one or more local groups to try to make this happen. They could be considering working with a group outside Venezuela, analogous to the group that tried to carry out the failed Operation Gideon, or with various groups inside Venezuela.”

Several forecasters emphasized Trump’s deliberate ambiguity in his messages about regime change intentions: “we’re not talking about that,” later, “we’ll see what happens… It’s not an option or a non-option.” In their view, the vagueness is strategic – preserving leverage over Caracas while avoiding an explicit commitment that could alienate anti-intervention conservatives.

Still, all agreed that current assets were insufficient for outright regime change.

Some forecasters, however, pointed to longer-term drivers, especially oil and China’s role. They noted that most Venezuelan crude now flows to China through sanctions-bypassing channels, and raised the possibility of Beijing seeking a military foothold. From this angle, U.S. action could be less about counternarcotics and more about denying China access, or even taking control of strategic assets.

Finally, forecasters considered how a strike might play domestically. One expected Trump’s base to back a limited operation, with one caveat: “Trump has already pretty much justified an attack and his supporters praised him for attacking Iran, so it does not seem like this would be much of an issue – unless maybe there’s a U.S. death.” In that scenario, anti-intervention and isolationist voices within his coalition could sour quickly, invoking his “no new wars” campaign promise.

Analogies to previous U.S. operations for base-rates

Some forecasters approached the problem heuristically, asking how often Trump opts for dramatic action when it’s credibly on the table. One explained their method to find a base-rate:

“My quick list was: Syria 2017 (Yes), Syria 2018 (Yes), Iran drones 2019 (No), Saudi Aramco attacks 2019 (No), Moves against Venezuela 2019 (No), Soleimani 2020 (Yes), Strikes on Yemen 2025 (Yes), Strikes on Iran 2025 (Yes), Mexico Cartel Invasion 2025 (No) [which] gets me to 55% of the time there’s speculation about whether Trump will take some dramatic action.”

Others leaned on timeline analogies, pointing to the June strikes on Iran’s nuclear facilities:

“Comparing the current situation to the hits on Iran nuclear facilities, the first trainings with Israel were in March and the hits were on June 22, that gives about a three month timeframe, which is rather close to what we are forecasting here. However, I’d say a hit on Venezuela does not need as much carefulness as one on Iran does so it’s likely to happen faster if it does, Trump is not an especially patient person against the weak.”

Taken together, these analogies led forecasters to a practical view: with military assets already deployed, a limited stand-off strike could be executed within weeks once the political decision is made, without the mobilization an invasion would require.

Finally, several tied these analogies back to the present: repeated emphasis that recent strikes were conducted in international waters signals an intent (so far) to keep operations below the threshold of escalation. That bolsters the lower forecasts, unless and until the White House opts for a discrete, low-risk strike on Venezuelan territory, most expect air or missile, not amphibious or ground raids.

What separates forecasts

Low-end estimates emphasized coercive signaling and bargaining over escalation. A forecaster on a 28% probability said: “We’re in a progression: intimidation; demonstrations of force short of territorial strikes; negotiations and demands; maybe tighter sea control to interdict oil shipments […] a land strike is a lot of political risk for thin reward.”

That camp also drew on Trump’s consistent stress that actions so far have stayed outside Venezuelan borders. They also argued the November 2025 timeline is too short for major action: “The U.S. is tightening the noose on Venezuela, but I do not see the value of land strikes in Venezuela just yet. Likely in the future, [the U.S.] would tighten sea lane access under the guise of fighting drug trafficking. That would have the benefit of choking off Venezuela's oil revenue, and further weakening the regime. During all this, Trump would demand concessions from Maduro of some form or another, as he is so far, such as taking back Venezuelan citizens. If he is frustrated in such efforts, or decides the situation remains unsatisfactory for some reason, then perhaps the U.S. would try for a decapitation strike and regime change. But not until they have strangled the country of sea traffic and then brought in considerably more hardware.”

High-end forecasts, by contrast, pointed to current momentum and credibility risks. One forecaster (who assigned a 65% probability) said: “If nothing happens, wouldn’t the whole thing look very foolish? I am inclined to think that it's going to be a Chekhov gun’s rule: The U.S. forces accumulated in the Caribbean have got to do *something*”, suggesting that Washington might opt for at least one limited, discrete strike on Venezuelan territory to validate the posture, with escalation risk contingent on Caracas’s response.

Finally, third-party dynamics (e.g. Venezuela’s Russian-supplied S-300 air defences and ties to Moscow) were cited as both a brake on deeper action and a nudge toward a one-off warning strike.

Conditional scenarios

To understand not just whether the standoff escalates but what escalation would mean, Swift Centre forecasters considered three conditional scenarios:

Conditional on a U.S. operation, will Chevron cease oil production/export in Venezuela before 2026?

Conditional on a U.S. operation, will China or Russia supply additional weapons before July 15, 2026?

Conditional on a U.S. operation, will Nicolás Maduro cease to be president before 15 July 2026?

For each, they provided both a baseline probability and the same outcome conditional on a U.S. strike inside Venezuela. The scenarios were designed to capture the main channels through which such a strike would reverberate: economic continuity and energy markets, external alignment and great-power signaling, and domestic regime stability. This structure let us estimate the marginal effect of a U.S. strike on adjacent systems while surfacing concrete implications for decision-makers.

Conditional on a U.S. operation, will Chevron cease oil production/export in Venezuela before 2026?

Result: Baseline 19%, rising to 32% if the main question resolves “Yes.”

A U.S. strike meaningfully increases the odds that Chevron halts operations (to roughly one-in-three), through several plausible channels: license tightening in Washington, retaliation from Caracas, or operational blockages such as port access, insurance, and staff safety.

Forecasters started by considering reasons for Chevron to stick around: the Treasury license runs into early 2026; Chevron has already re-routed tankers and sunk costs; and oil majors typically remain in difficult environments. As one put it:

“Every party… benefits from Chevron operating… oil is a business that does not care too much about PR and [they] will try to stay as long as possible.” Another added: “Chevron lobbied hard… and won out against hawks,” suggesting a fast u-turn would cost the White House political capital.

On the other hand, they emphasized that a military action inside Venezuela would be categorically different from recent international-waters strikes, which have left Chevron untouched. As one put it: “A military engagement [...] may lead to a different outcome, though, especially if it escalates into semi-regular exchanges between the two sides. In the [...] event that the U.S. intervenes in Venezuela in a significant way (to bring about regime change, for instance), Chevron would very likely halt its operations and evacuate its staff. U.S. oil companies seem to have done this during America's interventions in Iraq and Libya…”. Another highlighted preemptive exit risks: “It’s possible that if the non-renewal is known to Chevron before January 2026, it will announce ceasing operations [by the end of 2025]”. A third raised a coercive scenario: “There is a chance that the U.S. would coordinate with Chevron to cease operations before a strike as a final ultimatum and maximum-pressure campaign”, acknowledging this event as unlikely.

Critically, forecasters found that the continuity of Chevron's activity depends to a large extent on the purpose and scale of any U.S. strike. If Washington hits alleged narco sites and then stands down, many forecasters expect Chevron to keep operating, given sunk costs and recent cargo flows. But if the operation signals regime-change intent or spirals into sustained exchanges, insurers, shippers, and corporate risk committees would push for evacuation or shut-down.

Overall, Chevron halting operations remains a credible near-term risk, especially if certain warning signs emerge, such as hints of license tightening, security incidents near ports or oil sites, or direct retaliation from Caracas tied to a political strike.

Conditional on a U.S. operation, will China or Russia supply additional weapons before July 15, 2026?

Result: Baseline 35%, rising to 38% if the main question resolves “Yes.”

The conditional bump is modest (just +3 pp).

On the one hand, forecasters found that a limited U.S. strike that leaves Maduro in power could prompt Russia (and, to a lesser degree, China) to make symbolic statements of support, such as committing to supply additional weapons. They pointed to Moscow’s defence ties and recent rhetoric toward Caracas, and to reports/rumours of exploratory Chinese J-10C talks, which keep a public pledge plausible. As one noted: “Maduro proclaimed […] [the] development of missile and anti-missile systems with Russia’s help… a similar announcement by Russia is not unlikely before next July.” Another noted that “Russia has reasonable incentive here to signal cheaply.”

On the other hand, forecasters that are on the low probability end emphasize that public commitment is less likely than quiet supply. Several stress that overt announcements are costly and avoidable. As one said: “The public commitment part is the tricky one… I haven’t been able to find many [historical] cases.” According to them, making “no announcement” is the base-case even if material support flows.

Others went further, arguing that a U.S. strike could actually deter public pledges by raising direct confrontation risks: “If the U.S. engages, I consider the probability lower… Russia is stretched; China doesn’t want this fight; interdiction risk along the coast is high”. Another added that neither China nor Russia wants the reputational risk of equipment being destroyed on camera in the Caribbean, where they lack the naval power to project influence.

One forecaster emphasized China being particularly cautious in this conflict: “All in all, I think China is being extremely careful not to antagonize the U.S. directly over Venezuela, and I expect that approach to continue. While China would like to see its overall influence grow in Latin America, in general, and in Venezuela, in particular, it is patient. And it has more pressing concerns closer to home, including the future of Taiwan. I don't expect China to publicly commit to supply additional weapons to Venezuela by next summer.”

Overall, forecasters predicted that a U.S. strike would slightly increase the odds of a public pledge, driven mainly by Russia’s appetite to poke Washington, but tempered by fears of escalation and the costs of going public. The requirement of a public pledge, together with Monroe Doctrine optics, China’s restraint, and Russia’s stretched capacity, keeps the uplift small. Still, the baseline forecast was already relatively high, reflecting existing defense ties and the possibility of symbolic signaling even without a strike.

Conditional on a U.S. operation, will Nicolás Maduro cease to be president before 15 July 2026?

Result: Baseline 17%, rising to 33% if the main question resolves “Yes.”

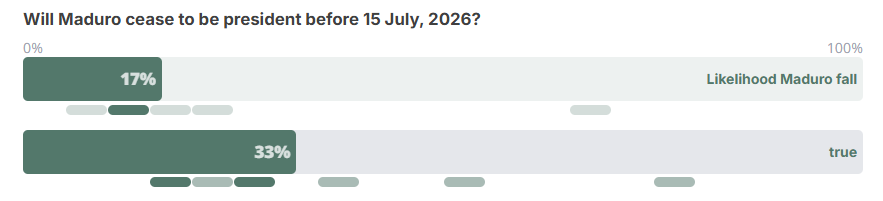

Forecasters saw the probability of Maduro’s exit nearly doubling under a U.S. strike.

At baseline, a majority stressed that Maduro’s position was relatively entrenched. One (at 11%) noted the U.S. history of toppling leaders in the Americas (citing Haiti in 2004 and Honduras in 2009), emphasizing that Venezuela was larger, more consolidated, and lacked imminent elections. In their view, a limited confrontation could actually strengthen Maduro, so long as he offered Trump symbolic wins. “Trump has a history of admiring dictators and strongmen. His approach to foreign policy is transactional and encouraged by flattery,” the forecaster noted, suggesting that an “easy path forward” for Maduro would be to offer concessions such as reducing ties with China, opening space for U.S. corporate ties, and appearing to crack down on narco-trafficking. According to them, as long as that bargain was held, a limited confrontation with Washington could even bolster Maduro at home.

What moved probabilities upward was the pathway created by U.S. forces in case of an attack.

On the higher side, some argued that even a limited operation could fracture authorities’ cohesion. As one forecaster put it: “It has never looked good for a government when the U.S. decided to attack their country and outside of a few exceptions that had major support (often from the USSR or Russia...), like Syria which temporarily survived, most governments have fallen following a U.S. attack. Once you get into that kind of scenarii, things can spiral out of control pretty fast for the attacked.”

Another suggested that a targeted capture/kill attempt was plausible, without a full invasion: “An invasion force is not being massed, but an invasion is not necessary for a targeted killing or apprehension of Maduro”. This forecaster put their baseline odds of Maduro well above the average to 65%, and pushed it up to 75% in case of a U.S. operation. They explained: “I think there is approximately a 80% of a U.S. military strike on Venezuela by the end of the year, and I think the administration's goal is regime change. With the administration circulating a draft of a bill that would authorize the president to kill alleged narco-terrorists and to attack countries alleged to be harboring them, and The New York Times reporting that Special Ops forces have been deployed to the Caribbean (although, admittedly, that could be for a large variety of reasons), I think the goal here is pretty clear. While U.S. involvement does not guarantee that Maduro will fall, I think that outcome is most likely”.

Another (at 38%) took the view that: “even if there is an engagement between the armed forces of the U.S. and Venezuela, I think there's only a 2 in 5 chance that this will actually presage a regime change attempt by the U.S.. But any such attempt would very likely be successful at removing Maduro from power one way or another, despite Venezuela’s size and terrain. Maduro could go into hiding and cease to be the President, for example.”

The median view, though, tied the conditional tightly to why and how Washington acts. If the strike were limited (e.g., to narco-site) and not part of a regime-change campaign, most expected no immediate collapse. They interpreted U.S. intent as coercive bargaining rather than decapitation: “The point is to coerce concessions… Trump would only depose Maduro as a last measure, and maybe not even then”.

Here again, forecasters drew an analogy with the situation in Iran, arguing for the possibility for Maduro to stay in power even after U.S. strike. One said: “the most likely scenario in case of a U.S. strike does not involve regime change. [...] The Iranian regime still holds, despite rather humiliating strikes by both Israel and the U.S. \~3 months ago.”

In sum, forecasters saw Maduro as relatively entrenched at baseline, with persistence the more likely outcome. But a U.S. strike roughly doubled the probability of his exit, lifting it into the one-in-three range.

Conclusion

Swift Centre forecasters judged that the U.S.-Venezuela standoff has moved beyond routine counternarcotics operations into a more volatile phase where (limited) strikes on Venezuelan territory are a live possibility. While most still saw full-scale conflict as more unlikely than likely in the near term, the risks of significant disruption (to Maduro’s hold on power, to Chevron’s operations, and to wider geopolitical alignments) were judged to rise materially if the U.S. crosses that threshold. Conditional forecasts showed consistent upward shifts, underlining that escalation would meaningfully increase strategic uncertainty across multiple domains.