Will the US economy enter stagflation?

Key forecasts:

US stagflation (unemployment over 5.5%, CPI over 4%, and GDP growth below 1.5% for 2 consecutive quarters) by the end of 2024: 14%

Oil price shock deemed a key factor. WTI oil averaging above $75 this year: 37% (increasing stagflation risk to 23%)

A top-10 US bank failing: 17% (increasing stagflation risk to 22%)

Major El Niño likely, but no impact on stagflation risk

Stagflation would decrease the Democrats' chances of winning the 2024 presidential election: 54% → 43%

Does stagflation loom? Larry Summers, the former United States Secretary of the Treasury, warned in April that his country has “got a bit of a stagflation problem brewing”.

Stagflation is the dreaded combination of slow, or negative, economic growth (stagnation); rising prices (inflation); and rising unemployment. It is dreaded not only because of the undesirability of its three constituent conditions, but because policies that treat inflation often accelerate unemployment, and vice versa. Stagflation, therefore, is difficult to escape from – as Americans found in the early 1970s.

Fifty years later, there are signs that a return to stagflation might not be as remote a possibility as policymakers would like. In April this year, American inflation was at 4.9% — a reduction from the 9.1% of last June, but more than double the target (2%) of the Federal Reserve. The jobs market remains strong, but Summers said of growth: “If the Fed does what’s necessary to contain inflation, I think a slowdown is likely to come along”. He put the likelihood of the US falling into recession over the next 12 months at 70%.

What, then, about stagflation? How likely is it to return to American shores by the end of next year? In a survey of global fund managers, 86% said stagflation would be part of the macroeconomic backdrop — which sounds significant, but the statement is too vague to be particularly instructive.

We surveyed our forecasters on the same topic. They addressed stagflation’s dependence on external factors; its ramifications for the next presidential election; and, of course, its overall likelihood. The definition of "stagflation" that we forecasted under was defined as a scenario where, for two consecutive quarters, the unemployment rate averages over 5.5%, the Consumer Price Index (CPI) exceeds 4%, and the real GDP year-on-year growth rate falls below 1.5%.

Oil price spike

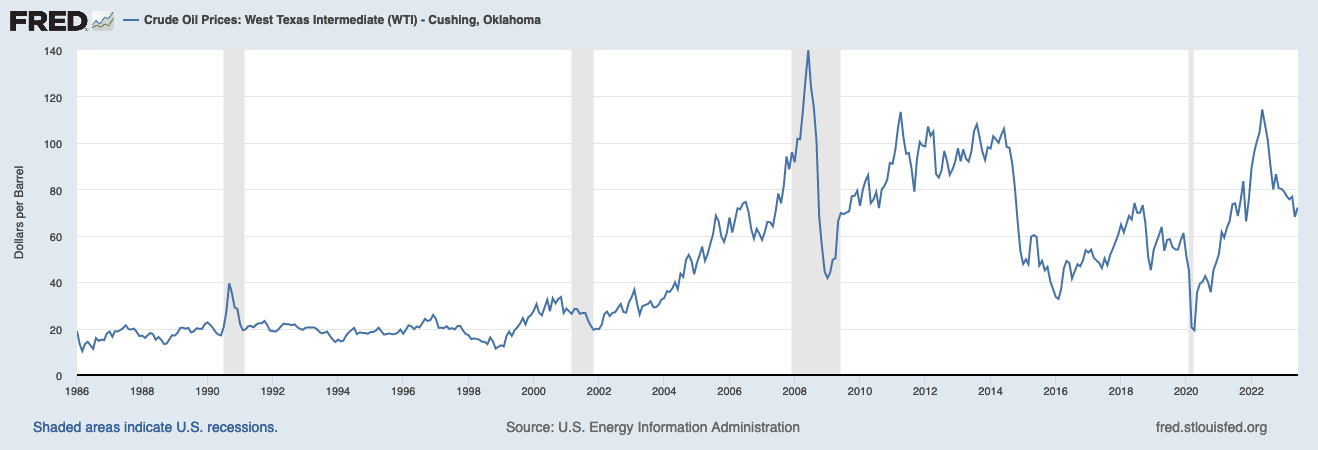

As the West was reminded when oil and gas prices spiked last year, energy costs have enormous effects on the wider economy. West Texas Intermediate, a type of crude oil often used as a global oil benchmark, was trading at $120 a barrel in May 2022, shortly after Russia invaded Ukraine. It is currently selling at about $72 a barrel.

What are the chances of stagflation in the event that the price of crude oil remains relatively high? The scenario our forecasters imagined was one in which the price of West Texas Intermediate averaged over $75 across 2023 – a scenario they collectively assign a 37% chance to.

In the event of West Texas Intermediate barrels hitting $75, the forecasters’ stated likelihood of stagflation stood at 23% — some way higher than the baseline forecast (their overall forecast of stagflation) which we will return to after covering the key factors that affect their thinking.

All our forecasters recognised the economic significance of elevated oil prices, but they varied in the extent to which they saw the $75 benchmark as being indicative of economic trauma. “High oil prices really could substantially drive stagflation,” wrote one forecaster, “but $75 isn't much compared to recent levels, so the effect would be modest”. Another was uncertain, but wrote that “high inflation plus a hike in the oil price sounds like a recipe for stagflation to me”.

(As usual, you can see our forecasters' detailed rationales when interacting with the embedded graphics.)

But what if the price of oil went higher? To cause real economic trouble, it wouldn’t need to hit the $120-a-barrel price it hit last year. What if the average price of a West Texas Intermediate barrel exceeds $90 next year? The forecasters' median estimate for the price over 2024 is $73.8, but they were uncertain, assigning a 22% chance of it exceeding $90. “Who’s to say?,” mused one forecaster. Another observed that “a conflict involving Iran could spike the price, but it is not likely”.

High oil prices could mean one of several things. One forecasters suggests that, rather than indicating stagflation, high prices “would usually be a sign that demand is high, which would suggest America's growth … would presumably be fine”. A more pessimistic view was that an average above $90 “would put a severe stress on the economy, and also be an indication that there is probably serious conflict or instability in a critical part of the world”.

All this amounted to a 24% chance that stagflation would arrive in the event oil barrels exceeding $90, according to the aggregate view of our expert forecasters.

A big bank failure

2023 has already seen the failure of three small-to-medium-sized American banks. These banks were Silvergate Bank, Signature Bank and, most significantly, Silicon Valley Bank. Global industry regulators, fearful of a financial crisis, were forced into action — of which the most notable move was the Swiss government-brokered deal by which the stricken Credit Suisse was acquired by its rival, UBS. There were fears that, despite such interventions, the contagion would spread and that bigger banks might be next to fall. So far, that hasn’t happened — but our forecasters still place a worryingly high likelihood on it happening.

Our forecasters place a 17% chance of a top-10 US bank failing in 2023. The joint-most optimistic of the forecasters pointed out that the US stock market has not gone down since the 2023 US bank failures, stating that “the market has clearly signaled that investors do not think there is much to worry about”. This forecaster’s view was that a big failure has a 10% likelihood, a figure that accounts for the instability of the current moment: post-pandemic economies combined with major geopolitical tensions.

Others were more pessimistic; one forecaster thought there was over a 1 in 5 chance of a top-10 US bank failing this year after researching US Bancorp, a bank that was recently the subject of a withering report by an asset management company. US Bancorp’s actions suggest they have a particularly large number of unrealised losses. The forecaster adds that they are "slightly more pessimistic after reading that the Fed didn't include rapid interest rate hikes in their stress tests” — stress tests being the Federal Reserve’s evaluations of whether banks can weather difficult economic circumstances.

The biggest pessimist in our panel gave the big-bank-failure scenario a 25% likelihood. Referring to the combination of falling liquidity, falling deposit bases and impaired asset values, this forecaster stated that the US banking system “has a very serious problem not easily solved”.

This forecaster was the second to refer specifically to US Bancorp, referring to its relatively high uninsured deposit base (49%), relatively low capital ratio, and large unrealised losses in its “theoretically” held-to-maturity security portfolio. If realised, wrote the forecaster, those losses would wipe out around 40% of Bancorp’s tangible common equity. They suggest that it is merely a matter of time until the hammer falls, but they could still make it to 2024.

But, if such a large bank were to fail this year, how does that affect the chances of the US entering a period of stagflation? According to our forecasters, 22% — a sizeable jump from their baseline estimation. However, contributing to that aggregate is a wide range of forecasts. At the lower end (4%), a forecaster believes that a big bank failure would be associated with a lower risk of stagflation, as it would suggest the Federal Reserve had over-tightened monetary policy. This measure would be associated with lower inflation, and therefore no stagflation.

However, interest rates being hiked at the expense of the US biggest banks would signal that inflation is proving difficult to bring under control. In such a scenario, the Fed would presumably have to hold back from further rate hikes in order to preserve the American banking sector. Half of our forecasters assign a probability of over 30% for stagflation under this scenario. However, they don't necessarily expect a bank failure of this size to be a signal of an economic crisis:

There's a reasonable chance one fails even if there are no more Fed hikes, since they're already quite distressed, and it wouldn't be unusual for one or more of the three parameters defining stagflation (inflation, growth, employment) to remain healthy after a big bank failure.

Major El Niño

What if economic headwinds were supplemented by real headwinds? And not your common or garden headwind, but the shifting winds of a major El Niño event?

El Niño is a weather pattern that arises when the Pacific Ocean is warmer than usual. During this event, the ocean’s jet stream moves further south. As the National Ocean Service explains, “with this shift, areas in the northern US and Canada are dryer and warmer than usual. But in the US Gulf Coast and Southeast, these periods are wetter than usual and have increased flooding”. Elsewhere, El Niño has a range of effects, but can be deleterious for industries such as South American fishing. It happens irregularly (every two to seven years) but has officially formed, as of yesterday.

Will there be a major El Niño by the end of 2024? El Niño events are considered 'major' when the sea surface temperature in a specific region of the Pacific (known as the Niño-3.4 region) is 1.5°C above average for at least three consecutive months. Our forecasters chose not to gainsay the domain experts, but the meteorologists' views did not provide a definitive interpretation. The forecasters looked at existing expert predictions, and, between them, expressed 52% confidence in a major El Niño before next year is out.

Forecasters recognised that El Niño could cause food supply issues, but found that the benefits, at least for the American economy, might outweigh the harms. One, diving deep into the consequences of previous El Niño events, noted that they seemed to bring down the price of American wheat. Another observed that although torrential rains might cause flooding and infrastructure damage, more rain in drought areas would help the economy rather than hinder it. “While it's going to have an impact,” a forecaster said of El Niño, “the good versus harm will probably balance out. The literature suggests it tends to be growth-enhancing for most countries (including the US)”.

El Niño, therefore, did not move the dial on our forecasters’ aggregate prediction of US stagflation.

The presidential election

Will a Democrat win the presidential election in November 2024? In September last year, our panel analysed the chances of a Biden win; here, they considered the prospect of a Democrat win (probably by Biden, but perhaps by another candidate) to be at 52% — a knife-edge. This is the baseline scenario — one without stagflation. Our forecasters noted Biden’s relative lack of popularity, which dents his incumbency advantage, but felt that he would still be more likely than Donald Trump, who remains the front-runner for the Republican ticket, to win a head-to-head. As one forecaster wrote: “Although Biden has low approval ratings... his electoral route to election is easier than his most likely opponent, Trump”.

If the election occurs in a stagflation scenario, however, the Democrats should be even less confident. In that event, the chance of a Democrat win falls, in the eyes of our forecasters, from 52% to 43%. They drew on historical precedent: the Democrats were holding in power when stagflation hit in the 1970s, and suffered as a result. Similarly, the early 1990s recession — a period which counts as stagflation under our criteria — contributed to the one-term ousting of George H. W. Bush.

“If I were Biden in a stagflationary scenario I would be extremely worried,” wrote one. “Although the incumbent has a number of tools to help him encourage people to vote for him just before the election… in a stagflationary scenario they wouldn't necessarily seem wise or politically achievable”.

The overall chance of stagflation

Overall, our forecasters put the chance of US stagflation by the end of 2024 at 14% — rather high for such a rare phenomenon.

Linking to the previously-mentioned article on a survey of global fund managers, a forecaster commented:

Stagflation is so rare, so it's a bit unreal that there is this level of agreement among these fund managers. That said, the article does not clarify what "part of the macroeconomic backdrop" entails. Thus, I don't think this necessarily means that 86% of these managers actually think stagflation will occur.

The forecaster pointed to relatively healthy trends in the US's key economic indicators — notably the reduction in inflation. Still, the survey significantly contributed to the forecaster outlook, putting a 25% chance on the US entering stagflation — the most pessimistic of the group.

The consensus of the group was that stagflation in the US, by our definition, is unlikely to be reached without some significant outside shock. Many noted that recent inflation figures were encouraging: “most peer countries and the US have been on a downward trend that I do not see reversing massively without an exceptionally potent shock”.

The possibility of such shocks is not negligible, though the magnitude of the considered options varies considerably. One forecaster provided their assessment of contributing factors, including those we chose not to investigate in-depth:

"The Russian invasion of Ukraine is unlikely to tip the balance."

"If China attempts to invade the mainland of Taiwan, all bets are off, but this is extremely unlikely before the end of 2024."

"A new and more deadly mutation of Covid-19 is possible, but there is already mass vaccination, levels of antibodies, and treatments available."

"Though recent failures of US banks could be a warning sign, the Fed has shown an ability and desire to intervene and limit the contagion."

"The US is less vulnerable to an oil crisis than we were in the 70's and 80's due to domestic production and an increasing move away from oil dependency with a shift to greener technologies and greater efficiency."

You can see our forecasts on the key factors at play here (and on this standalone webpage):