2025 - A Year in Review

For many, December is a time for reflection on the time gone by - what has the last year brought you, what challenges have you overcome or struggled with, and who do you know that deserves the best Christmas present and who deserves a piece of coal?

However, for the Swift Centre, December is slightly different. While all organisations across the world spend the year predicting what they think will happen, and predicting what their actions will do about it. In most cases they don’t even acknowledge that is what they are doing. Yet at the Swift Centre, we not only acknowledge it, we state explicitly what scenarios across geopolitics and tech we think will occur, how that changes under different circumstances, and what the consequences of those scenarios will be.

With this increased level of transparency comes increased scrutiny. Since we trade on the notion that we can identify the scenarios that matter to you and predict them with unparalleled accuracy - it’s only right that at the end of the year we state what we got right and what we got wrong. So that is why we’re publishing this report: “2025 - A Year in Review”.

The below list and analysis only includes our public forecasts that were due to be resolved at some point in 2025.

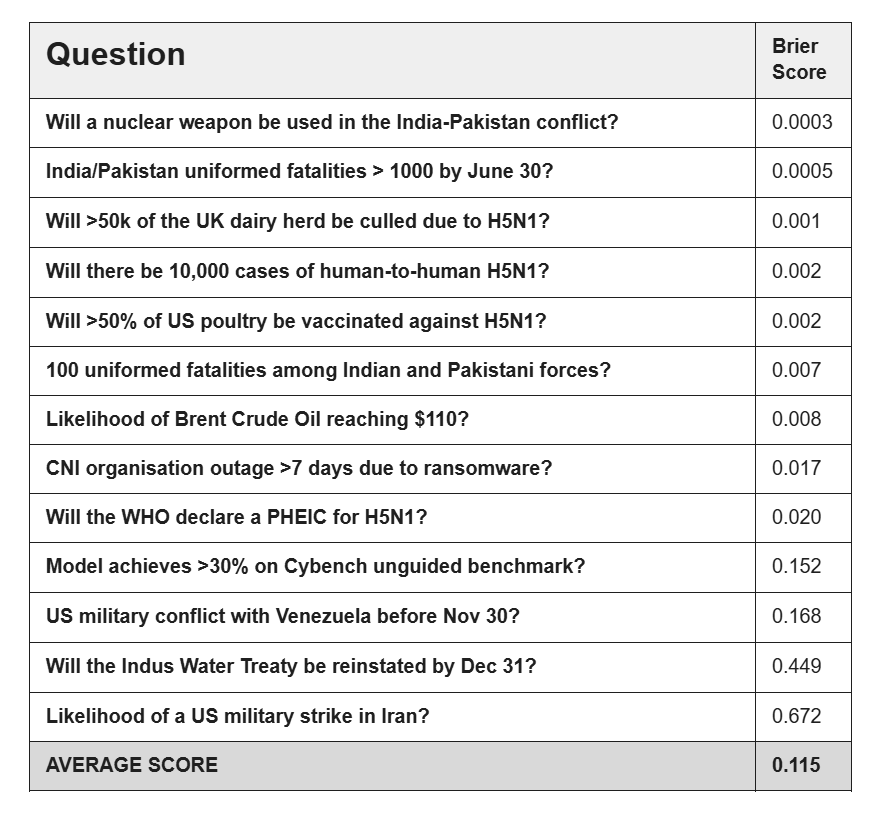

Summary: 2025 Forecasting Performance

Across the 13 likelihood forecasts we publicly made that resolved in 2025, the Swift Centre achieved an aggregate Brier Score of 0.115 (This score has not been difficulty adjusted). This represents an excellent forecasting performance.

Our portfolio demonstrated high calibration on low-probability/high-impact risks. We successfully predicted the containment of major threats such as the avoidance of significant war between India and Pakistan earlier in the year, the non-emergence of a H5N1 pandemic, and the resilience of global oil markets despite alarmist calls of price spikes following conflict between Israel and Iran. Crucially, our team also accurately navigated highly uncertain events such as the risk of the US engaging into a military conflict with Venezuela before the end of November, though noting the potential for this to occur later in the year/early 2026 - weeks before any large media outlet had started reporting on this growing geopolitical risk.

However, our performance was not flawless. We were more conservative on the chance of direct US military intervention in Iran and were more optimistic about the reinstatement of the Indus Water Treaty. These two forecasts account for the majority of our error penalty - as our Brier Score would have been 0.040 had those events outcomes been reversed.

As with all evaluation, the benefit of hindsight is not lost. Though it may appear a number of these questions were foregone conclusions now we are past the event, however, a quick review of the media around the time highlights how even the most extreme events (such as a nuclear war and the pandemic risk of H5N1/bird flu) were being reported as non-negliable events at the time of our forecasts. The Swift Centre’s value-add is being able to provide accurate analysis and predictions before and during a crisis, when other sources are creating noise that could send you astray.

Brier Score Explained

For those unfamiliar with a Brier score - it is like a golf score: lower is better, with 0 being perfect and anything above 0.25 being worse than random guessing.

0.25 (Random Chance): This is the score you would get by blindly guessing "50/50" for every question, essentially flipping a coin.

0.22 - 0.25 (The Average Person): Most untrained individuals typically score in this range. Without specific training, people often struggle to beat random chance due to cognitive biases (like overconfidence).

0.17 - 0.20 (AI Models): Current frontier AI models (such as GPT-4 and Claude 3) generally score in this range on forecasting benchmarks, performing better than the average human but often struggling to match elite human intuition on complex geopolitical nuance.

< 0.15 (Superforecasters): This is the "gold standard" achieved by the top 2% of forecasters who have demonstrated consistent accuracy over time.

0.115: Swift Centre score for our public forecasts resolving in 2025.

The Forecasts that Resolved this Year

Will there be 10,000 cases of H5N1 bird flu from human to human transfer by the end of 2025?

Did the event happen: No

As of December 2025, there have not been 10,000 cases of human-to-human H5N1 transmission. While there have been sporadic human cases globally, health agencies like the WHO and CDC consistently report no sustained human-to-human transmission. The vast majority of recent cases were caused by direct contact with infected animals.

Our Forecast: 4.5% likelihood

The Swift Centre forecasters converged on an average estimate of 4.5%, agreeing that while the spread of H5N1 in mammals (such as cows and pigs) had elevated the risk, a massive human-to-human outbreak by the end of 2025 remained unlikely. The group balanced this increased biological threat against the historical failure of avian flu to sustain human transmission; some of the team adjusted upwards from a strict annual pandemic base rate, while others adjusted downwards from a general influenza base rate. While anticipating more zoonotic infections among farm workers, the group generally doubted immediate pandemic potential, though they identified significant pig infections and untraceable community cases as critical warning signs that would have altered their probability.

Our Brier Score: 0.002

Will the WHO declare a Public Health Emergency of International Concern or a pandemic by the end of 2025?

Did the event happen: No

As of December 2025, the World Health Organization (WHO) has not declared a Public Health Emergency of International Concern (PHEIC) or a pandemic specifically for H5N1. While the WHO declared a PHEIC for Mpox in August 2024, the context of this forecast was explicitly tied to H5N1. Regarding bird flu, the WHO has maintained that the current public health risk is low, despite approximately 71 confirmed human cases in the U.S. and detections in various mammals.

Our Forecast: 14% likelihood

The Swift Centre forecasters deemed a PHEIC declaration more likely than the 10,000-case threshold. They noted that the WHO had historically declared emergencies for outbreaks with far fewer cases (such as H1N1, Ebola, and Zika). While some forecasters viewed the question as effectively tracking human-to-human transmission, others argued that a "COVID hangover" might prompt an institutional overreaction, leading the WHO to declare an H5N1 emergency earlier than objective measures might traditionally warrant.

Our Brier Score: 0.020

What will the case fatality rate (CFR) of H5N1 avian influenza in humans in the US be by the end of 2025 as reported by the CDC?

Outcome: ~2.8%

As of December 2025, the CDC reports approximately 71 confirmed human cases of H5N1 in the United States since the outbreak began in 2024.1 While the vast majority of these infections were mild (often presenting as conjunctivitis or mild respiratory symptoms in farm workers), there have been 2 recorded fatalities. This results in a Case Fatality Rate (CFR) of approximately 2.8%.

Our Forecast: 1.5%

The Swift Centre forecasters clustered closely around the status quo CFR of ~1.5%, largely rejecting the high historical mortality rates (50%+) of H5N1. Most forecasters reasoned that increased testing would identify milder cases, thereby diluting the fatality rate, and that available treatments would prevent severe outcomes. While some participants acknowledged that a widespread epidemic could drive the CFR down to <1% (due to even broader detection of asymptomatic cases), the consensus bet on the continuation of sporadic, largely mild infections similar to those observed in the ongoing US dairy and poultry outbreaks.

Our Accuracy: Under by ~1.9x (Our forecast was roughly half the actual observed rate of 2.8%)

Will more than 50% of US poultry be vaccinated against H5N1 by the end of 2025?

Did the event happen: No

As of December 2025, the percentage of US poultry vaccinated against H5N1 remains negligible and far below the 50% threshold. The USDA continues to prioritize biosecurity and culling ("stamping out") over vaccination. This policy is primarily maintained to protect the export market, as many trading partners currently ban imports of vaccinated poultry due to concerns that vaccines could mask active infection. While the USDA has stockpiled vaccine doses and field trials have been considered, no nationwide mass vaccination campaign has been implemented.

Our Forecast: 4.8% likelihood

The Swift Centre forecasters correctly identified that mass vaccination was highly improbable, citing the potential loss of export markets as the dominant constraint. They noted that the poultry industry, particularly the National Chicken Council, would strongly oppose vaccination because international trade rules often penalize vaccinated flocks. Additionally, forecasters pointed to the prohibitive costs of vaccination relative to the slim profit margins of broiler chickens and the political reluctance of the administration to enforce such a mandate. The team concluded that without a major shift in international trade agreements - which they deemed unlikely by the end of 2025 - the US would stick to its traditional strategy of culling infected birds.

Our Brier Score: 0.002

How many cattle in the US will be culled due to H5N1 in 2025?

Outcome: ~15,000

As of December 2025, the USDA has maintained its policy of not mandating mass culls for H5N1-infected herds, favoring isolation and recovery instead. While the outbreak affected over 1,000 herds cumulatively since 2024 (with significant clusters in California), the vast majority of cows recovered. Culling was largely voluntary and driven by economics (farmers removing cows that did not recover milk production), estimated at roughly 2-5% of infected animals. Reports describe 2025 as having "only a small number of states" with new cases compared to the initial spread in 2024, leading to an estimated total of approximately 15,000 cattle culled for the year.

Our Forecast: 38,000

The Swift Centre forecasters estimated a total of 38,000 culled cattle, anticipating a moderate increase from the estimated 15,000 culled in 2024. The consensus was that while the USDA would avoid mandatory mass culling (unlike the "stamping out" policy for poultry) to protect the industry, the spread of the virus to more dairy herds, particularly large operations in California, would drive up voluntary culling numbers. Some forecasters argued for lower figures (reducing the estimate by 3x) due to the lack of infection in non-dairy cattle, while others hedged higher (up to 60k-100k) to account for potential policy shifts or a more severe viral mutation, which ultimately did not materialise.

Our Accuracy: Over by ~2.5x

Will more than 50k of the UK dairy herd stock be culled due to H5N1 concerns by the end of 2025?

Did the event happen: No

As of December 2025, there have been zero confirmed cases of H5N1 in the UK dairy herd, and consequently, no culling of dairy cattle has occurred. UK government risk statements (such as those from HAIRS) continue to report that while the virus is circulating in US cattle, there is no evidence of it entering the UK cattle population, likely due to the lack of live cattle trade between the two nations.

Our Forecast: 2.6% likelihood

The Swift Centre forecasters correctly identified that a mass cull was extremely unlikely. Forecasters reasoned that for the virus to trigger a cull of 50,000 animals (roughly 3% of the national herd), it would first need to cross the Atlantic, a scenario they deemed improbable given the absence of live cattle imports from the US. Furthermore, they noted that even if the virus did arrive, the UK would likely follow the US precedent of low culling rates (<2%) rather than a "stamping out" policy for cattle, meaning an outbreak would have to be widespread to reach the 50,000 threshold.

Our Brier Score: 0.001

How many ransomware attacks will be reported to the UK's 'National Cyber Security Centre' between September 1st 2024 and August 30th 2025?

Outcome: ~730 (Estimated)

As of October 2025, the NCSC Annual Review reported a "record" number of cyber incidents, specifically highlighting a surge in ransomware. The Centre handled 204 "nationally significant" incidents (all types), a 130% increase from the 89 recorded the previous year. While the specific count of "ransomware reports" was not isolated in the summary, applying this 2.3x growth rate to the previous year's baseline of 317 ransomware reports suggests the total likely reached approximately 730.

Our Forecast: 341 reports (10th Percentile: 270 | 90th Percentile: 431)

The Swift Centre forecasters estimated 341 ransomware attacks would be reported to the NCSC, assuming a modest year-on-year increase from the previous baseline of ~317. The consensus was that while attack volume might rise due to the growing accessibility of AI tools, the NCSC's reporting numbers would remain relatively stable or grow slowly (around 6-10%) as they had in previous years. Forecasters generally doubted that geopolitical conflicts would drastically spike UK-specific reporting and assumed that "cyber hygiene" measures were successfully mitigating the growth of successful, reportable attacks.

Our Accuracy: Under by ~2.1x

A model achieves or exceeds 30% of solved tasks on Cybench's unguided benchmark before August 30th 2025

Did the event happen: No

As of August 30, 2025, no model had officially recorded a score of 30% or higher on the Cybench unguided benchmark. While highly capable models released in 2025 - such as GPT-5 (August), Claude 3.7 Sonnet (February), and o3 (January) - demonstrated massive gains on adjacent coding/agentic benchmarks (e.g. SWE-bench Verified scores jumping from ~49% to >70%), the Cybench leaderboard itself suffered from infrequent updates. The highest officially cited score during the period remained approximately 26.5% (achieved by Anthropic's Claude 3.5 Sonnet in late 2024) or 25% (o3-mini on the Princeton HAL tracker). Higher scores (such as a 39% by Grok-4.1) appeared on some trackers later in the year but were not verified or achieved before the August 30 deadline.

Our Forecast: 39% likelihood

The Swift Centre forecasters assigned a 39% probability, balancing the high likelihood that models capable of passing the threshold would be released against the significant risk that the benchmark itself would not be updated in time. Forecasters correctly anticipated the release of major frontier models (predicting "one more release" from OpenAI and Anthropic) and knew that 30% was a modest step up from the existing ~25% baseline. However, they heavily discounted their probability (down from a "capability" confidence of >95%) due to the "political negativity" of cybersecurity benchmarks and the historic sluggishness of the Cybench leaderboard.

Our Brier Score: 0.152

An organisation designated as 'Critical National Infrastructure' will have a significant outage for 7 days or more due to a ransomware attack, by August 30th 2025

Did the event happen: No

While Marks & Spencer (M&S) suffered a massive ransomware attack in April 2025 that crippled its stock management systems for over two months, the organisation itself is not designated as Critical National Infrastructure (CNI). A sophisticated attack attributed to the DragonForce and Scattered Spider groups paralyzed M&S's supply chain from late April through July, causing widespread stock shortages and suspending online services well beyond the 7-day threshold. The Co-operative Group faced a similar 3-week outage. Although "Food" is officially one of the UK's 13 designated CNI sectors, individual retailers like M&S are classified as private operators within that sector rather than designated CNI entities themselves.

Our Forecast: 13% likelihood

The Swift Centre forecasters assigned a low probability (13%), correctly assessing that a confirmed breach of a formally designated CNI entity was unlikely. They correctly distinguished between high-impact private sector outages and the formal definition of CNI failure, avoiding a false positive on this question.

Our Brier Score: 0.017

Average amount paid out to ransomware attackers by UK organisations in 2025.

Outcome: ~£4.0 million

As of late 2025, the Sophos State of Ransomware in the UK report revealed a dramatic divergence between the UK and the rest of the world. While global median payments dropped to approximately $1 million (£780k), the median payment made by UK organisations doubled year-on-year to approximately $5.37 million (~£4.1 million). Reports have highlighted that UK victims were paying five times more than global peers and, unlike other regions, frequently paid more than the initial ransom demand (averaging 103% of the ask)..

Our Forecast: £966,000

The Swift Centre forecasters estimated a payout of £966k, largely expecting the figure to track with the global trend of stabilization or slight decline. The consensus was that an increase in the number of attacks (driven by AI and less sophisticated actors) would dilute the average payment size by including more "small fish" targets. Forecasters failed to predict the specific systemic weaknesses in the UK market, such as a lack of cyber skills and heavy reliance on insurance payouts, that would drive UK ransom values in the opposite direction of the global average.

Our Accuracy: Under by ~4.1x

100 uniformed fatalities among Indian and Pakistani military forces by May 15

Did the event happen: No

As of May 15, 2025, the total count of uniformed fatalities in the India-Pakistan theater remained well below the threshold of 100. On April 22, 2025, a terror attack in Pahalgam killed 26 tourists. This sparked a major crisis, but the victims were civilians, not uniformed personnel.In response, India launched "Operation Sindoor" (May 7–10), involving air and missile strikes on alleged militant camps in Pakistan. Pakistan retaliated with drone and missile strikes. While the conflict was the most serious since 2019 (with Pakistan claiming to have shot down several Indian aircraft), verified uniformed losses were limited (estimated at fewer than 20 fatalities, primarily from air losses and border shelling). The majority of casualties were identified as civilians or militants, not uniformed military forces.

Our Forecast: 8.5% likelihood

The Swift Centre forecasters correctly assigned estimated there was a low likelihood to the outbreak of a major war, counter to much of the media around that time. Forecasters accurately predicted that while a mass-casualty terror attack (like the Pahalgam incident) would trigger a rapid cascade of retaliation, nuclear deterrence and international pressure would act as brakes on the escalation. The group correctly anticipated that any military response would be targeted (like Operation Sindoor) rather than a full-scale invasion, keeping uniformed losses low despite the high political tensions.

Our Brier Score: 0.007

Will a nuclear weapon be used as an act of war in the India-Pakistan conflict before June 30?

Did the event happen: No

As of June 30, 2025, no nuclear weapon has been used by either India or Pakistan. While the conflict in early May saw the most serious military escalation since 2019, the nuclear threshold was not crossed. Though with hindsight many claim this as obvious, at the time, multiple media sources and “experts” were highlighting the significant risk of nuclear weapons being deployed. However, international intervention (primarily by the US and UN) and the adherence to the 1988 Prohibition of Attack against Nuclear Facilities agreement helped contain the hostilities to conventional air and missile strikes, which ended in a ceasefire on May 10.

Our Forecast: 1.7% likelihood

The Swift Centre forecasters correctly assigned a very low probability to nuclear use, reasoning that the threshold for such an event would require an existential threat far exceeding the sporadic fighting and limited clashes experienced. Forecasters accurately predicted that even if the conflict escalated (as it did with the exchange of airstrikes), the nuclear deterrence and India's No First Use policy would likely hold. The group's theory - that most skirmishes, even violent ones, do not trigger the nuclear tripwire - proved resilient even in the face of the actual crisis and differences in “expert” commentary.

Our Brier Score: 0.0003

India/Pakistan uniformed fatalities > 1000 by June 30?

Did the event happen: No

As of June 30, 2025, the total number of uniformed fatalities in the conflict remained well below the 1,000 threshold. The Stimson Center estimated total fatalities for both sides at fewer than 200 (including militants and civilians), noting that the conflict explicitly failed to meet the political science definition of "war" (1,000+ combatant deaths). A ceasefire was agreed upon on May 10, and despite high tensions, no further major escalation occurred before the June 30 deadline.

Our Forecast: 2.3% likelihood

The Swift Centre forecasters correctly assigned a very low probability to a mass-casualty war, reasoning that if the conflict did not escalate immediately after the April terror trigger, it was unlikely to spiral into a 1,000-fatality war later in the year. They accurately predicted that any military response would likely be a contained episode, rather than a drawn-out ground war. The group's logic that modern escalation windows are short (weeks, not months) and that international pressure/nuclear deterrence would cap the violence proved robust.

Our Brier Score: 0.0005

Will the Indus Water Treaty be reinstated by Dec 31st 2025?

Did the event happen: No

As of December 17, 2025, the Indus Water Treaty (IWT) remains suspended (or "held in abeyance"). India unilaterally suspended the treaty on April 23, 2025, immediately following the Pahalgam terror attack, citing Pakistan's "state-sponsored terrorism" as a fundamental breach of trust. Despite the May ceasefire ending the conflict, diplomatic relations remain frozen. On December 16, 2025, India's envoy reiterated that the treaty would remain in abeyance until Pakistan "credibly and irrevocably" ends cross-border terrorism. This marks the first prolonged suspension in the treaty's 65-year history. While Pakistan has threatened that water diversion would be an act of war, India has currently paused the meetings and data sharing mechanisms rather than physically shutting off the river flows, though fears of future water weaponization persist.

Our Forecast: 67% likelihood

The Swift Centre forecasters were overly optimistic that the treaty would be reinstated, reasoning that the mutual benefit of the water-sharing framework would override temporary political tensions. Participants argued that initial suspension was likely just rhetorical posturing to satisfy domestic anger after the terror attack, and that cooler heads would prevail to prevent a hydrological catastrophe that neither side wanted. They failed to anticipate India's strategic shift to a harder line, where the treaty itself became a primary lever of coercion.

Our Brier Score: 0.449

Reported civilian deaths in Israel caused by Iranian military action before June 20, 2025?

Outcome: ~31 civilians

In mid-June 2025, a major escalation (dubbed the "12-Day Conflict" or "Operation Rising Lion") erupted between Israel and Iran. Following Israeli strikes on Iranian nuclear and military leadership on June 13, Iran retaliated with a barrage of approximately 550 ballistic missiles. Unlike the April 2024 attack, this volley overwhelmed localized defenses, causing significant civilian casualties. By June 20, reporting confirmed approximately 24-28 civilian deaths. Notable mass-casualty incidents included a missile strike on an apartment building in Bat Yam (9 dead) and a direct hit on a home in Tamra (4 dead). The final civilian death toll for the conflict was later confirmed at 31.

Our Forecast: 14 civilians

The Swift Centre forecasters estimated a lower death toll, anticipating a limited increase from the "zero to one" casualty baseline of previous exchanges. Forecasters generally assumed that Israel's air defense (Iron Dome/Arrow) would remain highly effective by intercepting >99% of missiles from Iran or that Iran would intentionally avoid civilian centers to manage escalation. Only a few forecasters estimated the death toll to exceed the actual number of 31, as they identified the risk that a saturated ballistic missile attack could break through defenses and hit urban residential areas which would cause a significant number of deaths through just a single effective missile hit.

Our Accuracy: Under by ~2.2x

Likelihood of a US military strike in Iran by July 1st 2025.

Did the event happen: Yes

On June 22, 2025, the United States officially joined the ongoing conflict (the "12-Day War") by launching direct airstrikes on Iranian soil. In a coordinated night raid, US Air Force B-2 Spirit stealth bombers dropped GBU-57 "Massive Ordnance Penetrator" (MOP) bombs on Iran's deeply buried nuclear facilities at Fordow and Natanz, while a US Navy submarine launched Tomahawk cruise missiles at support targets in Isfahan.

Our Forecast: 18% likelihood

The Swift Centre forecasters were more conservative on the likelihood of direct US intervention, largely assuming that the US administration's "America First" stance and aversion to new wars would create sufficient pressure against direct involvement. The majority reasoned that Israel had sufficient capability to handle the conflict alone, or that the US would limit its role to defensive interception. A few forecasters correctly identified Israel’s capability gap as it lacked the heavy ordinance (MOPs) required to destroy deep underground facilities Iran has and President Trump has a propensity for his variance for decisions that he deems would provide a dramatic “win”, especially militarily.

Our Brier Score: 0.672

Likelihood of Brent Crude Oil reaching or exceeding $110 per barrel by June 20 2025

Did the event happen: No

Despite the outbreak of direct conflict between Israel and Iran, Brent Crude oil prices did not reach $110. Prices spiked briefly to a high of $77.81 on June 23 (a ~13% war premium) but quickly retreated. Markets were calmed by high US inventory levels, China's strategic reserves, and the fact that the Strait of Hormuz remained open throughout the conflict. Furthermore, the rapid ceasefire announcement on June 24 caused prices to tumble back to the mid-$60s.

Our Forecast: 8.7% likelihood

The Swift Centre forecasters correctly assigned a low probability to the $110 threshold, accurately predicting that non-OPEC supply (particularly US shale) and high global inventories would act as a buffer against geopolitical shocks. This was against the narratives of other commenters who were suggesting a significant spike in the price of oil shortly after the conflict started. The consensus view that Iran would be deterred from actually closing the Strait of Hormuz, and that any price spike would be muted by weak global demand proved highly accurate. The war premium was real but insufficient to drive prices anywhere near the triple-digit levels seen in 2022.

Our Brier Score: 0.008

What will global Natural Gas Consumption be in 2025?

Outcome: ~4,175 bcm

As of December 2025, global natural gas consumption growth has slowed significantly, defying expectations of a "return to normal" trend. Preliminary reports from the IEA and World Bank (December 2025) estimate full-year growth at approximately 1.1%, bringing total consumption to ~4,175 bcm (based on the Energy Institute's 2024 baseline of 4,128 bcm). While European demand recovered slightly due to a colder winter and lower renewables output, the expected surge in Asia failed to materialize. Macroeconomic uncertainty and high spot LNG prices caused demand in China and India to stagnate, with China's LNG imports actually recording a double-digit decline in the first half of the year.

Our Forecast: 4,280 bcm

The Swift Centre forecasters assumed a return to trend growth of roughly 3.7% (building on the 2.8% rebound seen in 2024). The consensus view was that barring a major economic catastrophe, consumption would track the 10-year historical average of ~2% growth or higher. Forecasters anchored on the narrative that the post-pandemic/war volatility had settled and that Asian industrial demand would drive the total upward. On average the group did not sufficiently anticipate the persistent price sensitivity in Asian markets and the specific plummeting of Chinese LNG imports that dragged down the global average.

Our Accuracy: Over by ~2.5%

Will the US military engage in military conflict with Venezuela before November 30, 2025?

Did the event happen: No

As of November 30, 2025, the United States did not engage in a direct military conflict with the Venezuelan armed forces, nor did it conduct strikes on Venezuelan land targets. The US Navy continued its aggressive counternarcotics campaign, conducting over 20 lethal airstrikes on alleged drug boats in and near Venezuelan waters, killing nearly 100 people by late November. However, the US maintained that these were law enforcement actions against "narco-terrorists," not acts of war against the Venezuelan state. Tensions peaked right at the deadline. On November 29, President Trump declared Venezuelan airspace closed and threatened land strikes, but actual engagement with Venezuelan military assets or territory did not occur before the cutoff. A full naval blockade was only ordered later, in mid-December.

Our Forecast: 41% likelihood

The Swift Centre forecasters were divided, highlighting the uncertainty of this scenario. Skeptical forecasters assessed that the naval buildup was primarily designed to pressure Maduro into political concessions without risking a costly ground war. They accurately predicted that the administration would stick to boat strikes rather than crossing the threshold into state-on-state conflict. The more hawkish forecasters assessed that the massive deployment of assets must inevitably lead to land strikes or regime change operations within a short timeframe. The Swift Centre produced this forecast in September, weeks ahead of major news outlets reporting on the growing risks between Venezuela and the US. Highlighting not only our forecasting accuracy, but our ability to spot this scenario far in advance of others.